Terra’s Hedge in Africa: Transforming Nigeria Crypto Space

Africa is lagging behind the rest of the world in terms of crypto adoption. This lag can be credited to the long term lack of crypto with African descent. However, things are now changing, especially with the growth of crypto projects like TerraCredit.

Terra, a South Africa based blockchain company, is already transforming South Africa and Nigeria’s crypto space. According to reports, Nigeria has the highest percentage of growth in youths using cryptocurrency in the world.

Terra has a vast portfolio of crypto-based products that are helping shift the crypto market in the continent. Currently, they mostly focus on payment processing in developing countries in Africa, such as Nigeria. Each product under the company has a supporting role in the emerging market, but this article will focus on two; TerraCredit and Terrabit.

TerraCredit

TerraCredit is a blockchain Explorer and decentralized public ledger that assures users complete transparency of the CREDIT Blockchain. The platform uses proper proof of stake algorithms in the validation of transactions. Unlike proof of work, which requires a lot of energy, computing power, and knowledge, the POS algorithm is easy to use and highly profitable.

On the 1st August 2020, the community successfully advanced to CREDIT 2.0, undergoing a pre-established and very well-planned Hard Fork. The hard fork brought a decrease in block reward and introduced easy mobile app & desktop mining, along with Masternodes base governance (DAO). The launch of Masternodes brought to life a Decentralised Autonomous Organisation (DAO), TerraCredit now successfully operates and abides by its own community self-governance.

The platform is entirely automated, and it pays miners with newly mined coins instead of transaction fees. Unlike other cryptos that individuals need to obtain super powerful systems to mine new coins, terraCredit has made it easy. The terrabit app is on the google play store, and any person with more than 1000 credit in their wallet can quickly start completing blocks. A miner doesn’t need any kind of experience to complete blocks.

TerraCredit’s Value Against The Nigerian Naira

Nigerian Naira is the Nigerian currency, while Terra’s CREDIT is a worldwide cryptocurrency. The NGN-dollar conversion factor is made of 2 significant digits, while the CREDIT-dollar conversion factor had 12 significant figures as of last year. This year, however, the value of CREDIT has grown and even overtaken the Naira.

The price movements in the CREDIT tokens have been most promising, with trading volumes also increasing. The Terra credit value is a little higher than the cost of some of Africa’s fiat currencies. One Nigerian Naira has a value of $0.0026, while one Terracredit is valued at $0.01030646 as at the time of writing this writeup.

Paystack’s Partnership with Terrabit

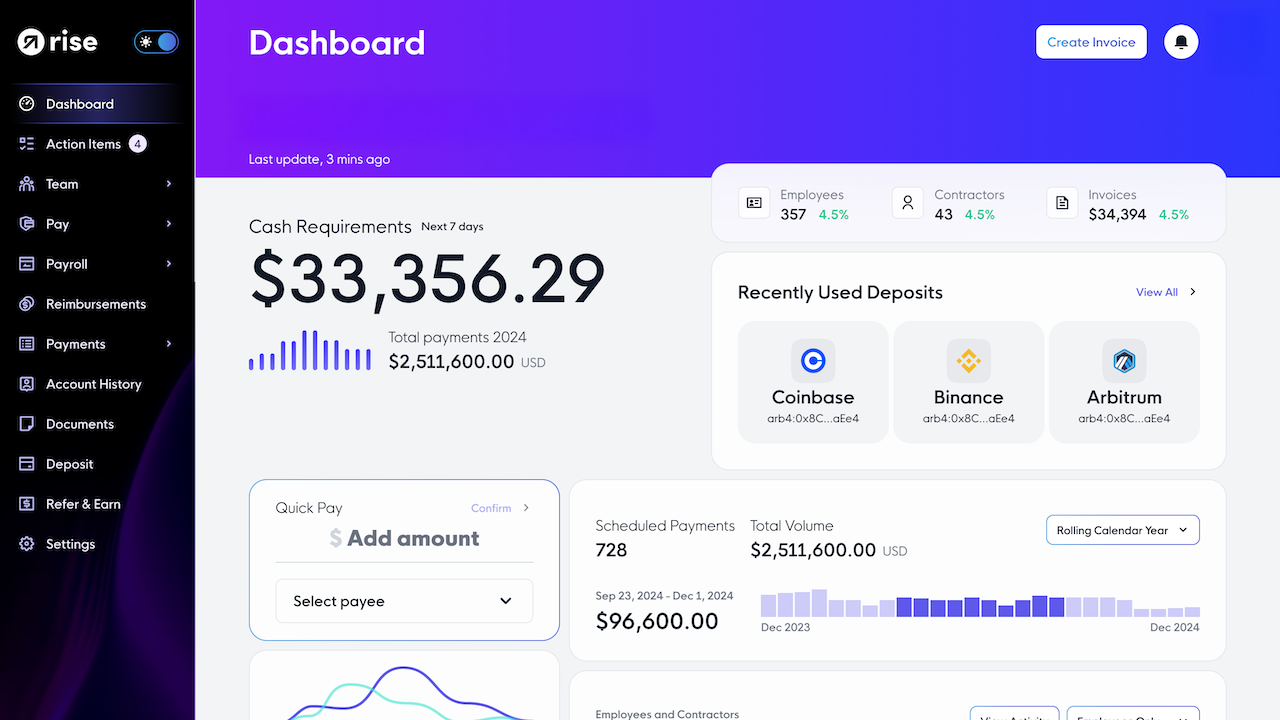

Paystack is an online payment processor that works with big brands, including Cowrywise, and is currently working with Terrabit. Paystack helps global brands complete fast, reliable, efficient transactions from anywhere in Africa. Paystack operates the deposit functionality in different countries in Africa, including Nigeria and Ghana.

Terrabit’s partnership with Paystack helps them offer a digital unbanked account that pays individuals 10% interest per anum. This partnership allows Nigerians to directly deposit Naira with credit or debit cards for withdrawals and deposits. Nigerians can do this easily from Nigerian bank cards and bank accounts, including US dollar deposits. This account provides you with your money at any time and wherever you are. What’s unique about this account is the fact it asks for zero fees.

Terrabit has a walk-in branch in Port Harcourt, Nigeria, to reach the country’s significant unbanked population. This exchange will allow its users to trade with bitcoins and CREDIT, which is a Terrabit token. CREDIT works in South Africa, Nigeria, Ghana, Kenya, and Colombia.

TerraCredit Plans in Africa

Terra’s token, CREDIT, has seen enormous growth in Africa in just the past few months. The platform helps users store, buy, sell fiat and cryptocurrencies, and ease the payment process. The terra blockchain is steadily hedging its way into the African market over time.

Since TerraCredit opened its investment doors in Nigeria, it has led Nigerians to high profits. These profits are a reflection of what the team has planned for the rest of Africa. Moreover, Terrabit is expanding its boundaries and growth options across the whole of Africa.

Other high crypto user countries, including Kenya, are to expect their market expansion soon. Africans should expect to see new Terra walk-in offices in their countries, which will help transform Africa’s financial system.

A future benefit to Africans is that their investment in the Credit puts them in a position of getting daily rewards. Web staking on terrabit and CREDIT comes with an annual ROI of 10%, and when compared to mining, this option is more profitable. Expanding into Nigeria has already allowed terrabit to access the big pool of active users while making gains from new users.

Another advantage brought about by terrabit is a very fast blockchain of 175 transactions per second master node. Recent upgrades included fast deals and hybrid proof of work that makes the system a highly secure network. Other updates include new rewards per block since terrabit gives a 10% interest per annum on block rewards. Terrabit is a critical link between the fiat and crypto worlds both in South Africa, Nigeria, and soon the rest of Africa.

Final Word

Crypto adoption is a delayed but inevitable event in the continent with the 2nd highest population. The high percent adoption of crypto in Nigeria shows that Africa is the best hub for crypto adoption; it only needs investors.

The strides made by Terra, from the introduction of the app and later the CREDIT, will foster faster adoption of crypto to Africa. The app has made it easy for African crypto enthusiasts to trade fiat to crypto.

Terrabit will create some level of trust in Africans that otherwise would never have been achieved with other platforms outside Africa. Terra is stepping on the ground that even bitcoin the crypto giants have delayed in reaching. Bitcoin and additional cryptocurrencies growth in Africa vastly depend on the fast growth of TerraCredit.

Source: Crypto Adventure

NEVER MISS AN ARTICLE!

We will get back to you as soon as possible

Please try again later

SUBSCRIBE TO OUR NEWSLETTER

Join the Newsletter

We will get back to you as soon as possible

Please try again later