Blog Post

Social Trading In Forex vs. Crypto: Learn the Major Differences and Similarities

Marius Bogdan Dinu • June 2, 2020

For newer traders, and even those with more experience but less confidence, social trading in both crypto and forex markets offers an excellent avenue for both learning and earning returns.

This system lets users access the same functions – charts, indicators, and buy/sell tools – but it adds a human layer, letting users share their knowledge and strategies with others, while informing their own decisions.

As such, social trading makes an excellent way to earn an investment income by copying the trades of a range of experienced, profitable traders on a social trading network.

In this guide, we compare and contrast Forex and Crypto social trading to unveil how they can benefit your investment endeavours, as well as examine top platforms offering quality social trading systems.

Social Trading is Easier in Crypto Markets

Copy/social trading utilizes a system that uses technology to replicate the trades or signals of other traders. It utilizes the concept of automated trading in Forex.

But the difference, in crypto markets, is that instead of picking trades based on the signals generated by a sophisticated algorithm, you automatically pick trades based on strategies of experts on the platform.

In both cryptocurrencies and forex trading, there are so many external tools that can aid traders in the making of more and more profits as they advance their art.

Probably, there are more tools, including advanced tools, for those who want to start trading Forex than there are for those willing to start trading crypto. However, it is harder for individuals to recognize, analyze, and capitalize on trends in the greater stock and Forex market.

This is not so with crypto where prices can increase and decrease in a much more tied version to one another and related to each other. Thus, in cryptocurrencies, experienced traders can effectively predict the movements in the market, but with stocks and Forex, it may be difficult to predict the larger issues that move markets.

In other words, there is a higher level of complexity to the Forex market and thus more to learn, which complicates attempts to utilize social trading in such markets.

The downside of trying to emulate other traders strategies in a complex Forex market with vast assets on offer is that there is a higher chance of applying inappropriate leverages that could increase the possibility of high losses.

More so, it is easier for a beginner to learn cryptocurrency trading from scratch before they can get started. Paper trading features have been introduced to major crypto exchanges for those trying to learn, which can be used in conjunction with social trading strategies such as copy and mirror trading.

Crypto Offers More Trading Pairs

In both Crypto and Forex markets, one would require a strong desire to learn through observing and copying successful trading strategies continuously.

That said, there are now more than 5,392 cryptocurrencies and altcoins

in the crypto markets, which presents one advantage for crypto traders; they have the option of choosing from a wide diversity of digital tokens for which to trade against each other. So if it’s a bad day for BTC, one could easily check if there is relief in ETH or some other low cap coin.

Having a range of trading pairs in crypto ensures there are more successful trades one can observe and mirror by applying social trading, ultimately boosting one’s ability to build a workable and beneficial crypto portfolio.

Volatility and Stability

Crypto trading has better volatility than Forex Trading, making it easier for crypto traders to take advantage of the small differences in exchanges.

However, Forex traders get the benefit of having liquidity easily. In simple terms, this means that you can easily trade any fiat currency with another. Liquidity with Forex also guarantees that large trades won’t change dramatically on the asking price. This is, however, the opposite for crypto traders.

That is the disadvantage to crypto trades. The price can shift immediately on big orders, meaning that copying the trading strategies of others requires constant revision as what worked a few hours ago may no longer be viable, especially when dealing with lesser-known altcoins.

Nonetheless, crypto trading is still growing as it is relatively easy to jump in and start trading immediately. There are a growing number of professional crypto traders whose strategies you can emulate to make lucrative yields from your coin holdings.

Although volatility is high in cryptocurrencies, large coins are continually doing better as crypto gains more mainstream use cases, which means the instability is decreasing. For instance, Bitcoin has over the years seen less dramatic volatility shifts which sometimes can be more synonymous with traditional stocks.

This is even more prevalent as crypto exchanges continue to witness deeper liquidity, and traders get a better understanding of how digital assets behave in the market. Ultimately, this is making the application of social trading easier and more reliable in crypto markets.

Platforms Offering the Best Crypto Social Trading

There are a growing number of well-established Forex brokers offering crypto social trading in 2020.

One example is eToro, a multi-asset investment platform which enjoys a high profile within the crypto space. The platform which is hailed as the world’s pioneer of copy trading, enables virtual assets such as btc to be traded alongside stocks, ETFs, and commodities.

On Tuesday, October 29, 2019, eToro announced the launch of its CopyTrader

trademark feature in the US. This feature allows traders based in the country to set their accounts to automatically copy the trades of all the top-performing crypto traders on the eToro platform.

The trades are copied in real-time and at the same price, which means there is no time differential risk between when the expert trader places their trade and the time the same trade is copied.

Similarly, Shrimpy

has emerged as a leading platform that offers the best social trading for cryptocurrency.

The platform has, in the past few months, been actively making strategic partnerships with crypto exchanges such as OKEx and HitBTC to simplify portfolio management by creating automated crypto portfolio management systems.

These systems work by letting users copy strategies from other successful traders, build an indexing strategy and connect via the Shrimpy unified crypto trading APIs.

Closing Thoughts

Social trading helps individuals make better investment choices through the power of the community. The strategy involves copying the trades of experienced investors in a fully-automated fashion on an online social trading platform like Shrimpy.

Forex trading would be more viable for those looking for more stable and regulated assets, while crypto is preferable for those who love to trade market volatility and where there is low capital and investment requirements.

Source: Crypto Adventure

Share

Tweet

Share

Mail

Disclaimer: This is not trading or investment advice. The above article is for entertainment and education purposes only. None of the content on Crypto Folds is investment advice nor is it a replacement for advice from a certified financial planner. Please do your own research before purchasing or investing into any cryptocurrency.

By Press Release

•

April 7, 2025

DeflationCoin formally launched a groundbreaking cryptocurrency with the purpose of fixing the economic and technological shortcomings of Bitcoin and Ethereum. The team is introducing a hard cap on the total supply with algorithmic deflation, smart staking, and more features. From this point of view, the DeflationCoin team built this project to propose the first crisis-resilient digital asset — able to endure financial turbulence, political disruption, and systemic debt risks. In essence, DeflationCoin introduces a whole new economic paradigm: the Minus Layer-1 (-L1) blockchain. DeflationCoin's platform innovates well beyond the sphere of the blockchain; it addresses global issues such as inflation and devalued currencies. Supported by a tongue-in-cheek developer with the nickname "Father of Satoshi Nakamoto," DeflationCoin has high ambitions. This project is making a serious real-world economic proposal with revolutionary systemic architecture. Fixing Bitcoin: A Deflationary Vision Fundamentally, DeflationCoin introduces a whole different economic model: the Minus Layer-1 (-L1) blockchain. DeflationCoin comes with a total cap of just 20,999,999 tokens and no future issuance, it guarantees zero inflation. In addition to limiting inflation, there's also deflation. This is a mechanism that increases the value of money by reducing its supply, unlike inflation which does the opposite. DeflationCoin’s team points out that Bitcoin’s halving only slows down the issuance rate but doesn’t reduce the number of coins in circulation. It has decelerating inflation (or “disinflation”), which is different from deflation. DeflationCoin features an innovative mechanism called “Deflationary Halving.” Unstaked coins are burned daily, with the burn rate doubling each day. The only way to preserve assets is to move them into smart staking. Here, coins are protected and generate yield from actual ecosystem revenues (and not inflationary minting, like in Ethereum and Solana). Smart Staking: No More Emotional Selling DeflationCoin's smart staking isn't a lock-and-earn system; it's a behavior filter. Users stake coins for 1-12 years and remove the likelihood of selling on a whim. Staking long-term boosts staking multipliers and grants voting rights in governance decisions. Unlike inflationary staking, rewards in DeflationCoin stem from real revenue. Its economy includes zero-fee exchanges, learning-based gambling components, meme-token trading pits, and more. This whole design feeds profits into a buyback and redistribution system. These smart dividends are paid on a monthly basis to long-term staked coins, not through the minting of new coins. The longer the lock-up, the bigger the reward multiplier. No Correlation to Bitcoin Traditional cryptocurrencies collapse in unison during bear markets. DeflationCoin is built to resist that. Its systems—including smooth unlocking and automatic buybacks of tokens during market downturns—help maintain price stability and preserve value. More details on this matter are available on DeflationCoin’s website and on its whitepaper . A Better Economic Model DeflationCoin openly criticizes inflation-prone models such as Solana and Ethereum. These coins have unlimited issue or inflationary staking. As the team puts it, even cryptocurrencies with capped supply, such as Bitcoin, suffer from economic issues, such as the fact that they lack an actual ecosystem. Instead, DeflationCoin reverses this reasoning with: Deflationary Halving: In contrast with Bitcoin’s halving of inflation, DeflationCoin’s burn mechanism literally reduces circulating supply daily. Smart Fees : The project’s fees include built-in affiliate marketing. This cryptocurrency aims to grow as fast as top exchanges thanks to this integrated referral system. No Mining: Direct investment of capital into expanding the ecosystem instead of computation-intensive mining. An Ecosystem Built around the End-User: DeflationCoin intends to focus on mass-market products that people can purchase, giving real utility to the user. A Digital State The long-term vision is bold: a deflationary online state with diversified revenue streams, integrated meme culture, and democratic governance via Proof of Deflation (PoD). PoD introduces merit-based proposals, voting weight based on staking duration, and a founder veto for strategic alignment. Every part of the project—from games to dating apps to trading platforms—feeds the economic engine that supports DeflationCoin. Profits are used to buy back tokens, half of which are burned, and the rest are distributed to loyal stakers. About DeflationCoin DeflationCoin is the world’s first cryptocurrency built on real deflationary economics, featuring mechanisms that protect against panic selling and price crashes — enhanced by next-generation meme marketing. Here are the project’s key takeaways: A hard-capped supply of 20,999,999 coins Daily smart-burning of idle coins Smart staking with 1–12 year lockups Smart dividends paid from ecosystem revenues Deflationary halving system Zero mining, zero inflation A growing ecosystem of real products The project comes from the humorous but mysterious "Father of Satoshi Nakamoto" and has a fully KYC-verified team. DeflationCoin sets out to challenge Bitcoin’s dominance with superior tokenomics and real-world relevance. Anyone wishing to know even more about DeflationCoin can visit the project’s website , read its extensive whitepaper , and check out its presentation video . The social media pages below are a very good way to keep in touch with this ambitious team. X (Twitter) | Telegram | LinkedIn | YouTube

By Press Release

•

April 4, 2025

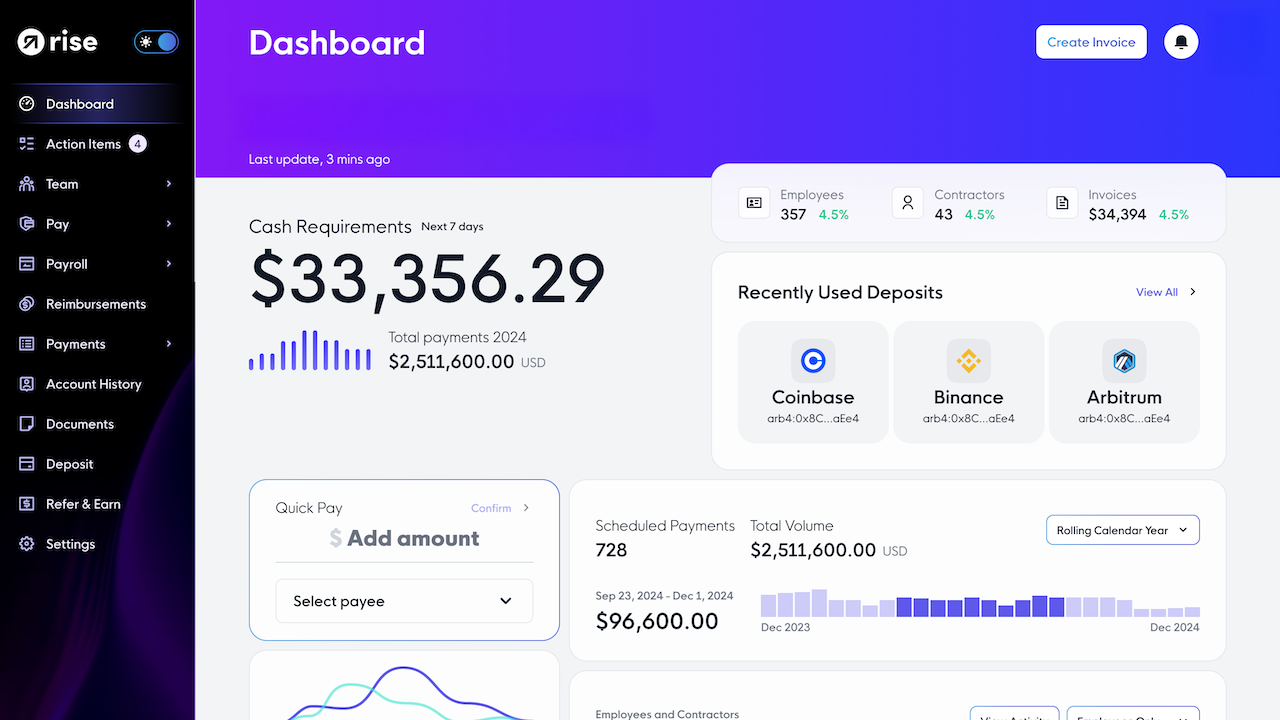

Rise confirms its reputation as one of the world’s leading hybrid payroll platforms with new and revolutionary solutions. Its Employer of Record (EOR) is the only payroll service allowing employees to earn payments in either fiat or cryptocurrency. This exclusive feature is just one of the many reasons behind Rise's stellar development, which recently helped the company surpass $500 million in total payroll volume paid to global teams. Why Rise’s EOR Trumps the Competition An Employer of Record (EOR) is a service that enables businesses to hire and manage employees in foreign countries without establishing a local entity. It also acts as the legal employer in those respective jurisdictions and handles administrative and compliance-related tasks. EOR is an excellent solution for companies operating with overseas contractors and employees, as it allows them to focus on growth and strategy. Navigating international hiring laws and payroll compliance remains one of the biggest challenges for scaling businesses. Hugo Finkelstein, co-founder and CEO of Rise, highlights how modern solutions simplify this process: “Global hiring has always been a challenge for businesses due to legal complexities and administrative burdens. Our Employer of Record services remove these barriers, enabling companies to hire top talent anywhere in the world while staying fully compliant. This is a transformative step toward building a truly borderless workforce.” By leveraging an Employer of Record (EOR), companies can expand globally without setting up local entities—making Finkelstein’s vision of a borderless workforce more achievable than ever. Rise has established a solid position in the international workforce payments industry from its early days. The company is renowned for streamlining payments and compliance tasks, helping businesses worldwide pay their contractors and teams in local currencies. However, innovation is key to remaining relevant and thriving in this increasingly competitive sector. That's why Rise created a unique Employer of Record that stands out from the services delivered by traditional payroll providers. Rise's EOR goes a step further by offering payments in both fiat and cryptocurrencies, including stablecoins, such as USDC. This feature is a game changer for companies that regularly use blockchain technology and digital currencies. It is equally important for contractors, teams, freelancers, and other cross-border employees, who can withdraw their earnings in their preferred currency. Notably, Rise allows you to withdraw in one of 90+ fiat options or over 100 cryptocurrencies. Rise owns numerous entities in the United States, United Kingdom, and Canada, helping businesses employ talent without navigating complex labor laws or setting up costly local subsidiaries. Moreover, the company plans to expand to over 60 countries by the end of 2025. Rise's EOR service includes several perks for employers. The company takes care of the formalities involved in hiring overseas talent, such as KYC, AML, taxes, and employment contracts. Businesses can use this service to fund payroll in US dollars or USDC stablecoin and set up payments according to local requirements. Lastly, employees can withdraw earnings in the local currency or cryptocurrency. The addition of crypto payments to Rise's EOR service means Rise can ensure compliance with local regulations while providing payroll flexibility and competitive employee benefits. Ultimately, Rise's EOR caters to the increasing number of companies using modern global teams and reflects the growing adoption of crypto payments in the workforce. About Rise Rise is a hybrid payroll and international contractor payment platform designed for global teams with distributed workforces. The company provides several effective solutions to simplify payroll and cross-border payments while ensuring business compliance with laws and regulations in foreign jurisdictions. Rise operates in 190 countries and provides several other services besides its unique Employer of Record solution. The company's offer for globally expanding businesses includes Direct Payroll, accounting, cryptocurrency integrations, and advanced crypto payment options. After reaching $500M in payroll processed, Rise aims for $1 billion in total payouts, further cementing its reputation in the workforce payments industry. Follow these official links to learn more about Rise and its services: Website | Rise’s EOR | (X) Twitter | YouTube |

NEVER MISS AN ARTICLE!

Sign up and stay up-to-date about what's happening at our site.

Thank you for contacting us.

We will get back to you as soon as possible

We will get back to you as soon as possible

Oops, there was an error sending your message.

Please try again later

Please try again later

SUBSCRIBE TO OUR NEWSLETTER

Join the Newsletter

Thank you for contacting us.

We will get back to you as soon as possible

We will get back to you as soon as possible

Oops, there was an error sending your message.

Please try again later

Please try again later

IMPORTANT DISCLAIMER: All content provided herein our website, hyperlinked sites, associated applications, forums, posts, social media accounts and other platforms or websites, is for your general information only, procured from third party sources. We make no warranties of any kind in relation to our content, including but not limited to accuracy and updates. No part of the content that we provide constitutes financial advice, legal advice or any other form of advice meant for your specific reliance for any purpose. Any use or reliance on our content is solely at your own risk and discretion. You should conduct your own research, review, analyze and verify our content before relying on them. Trading is a highly risky activity that can lead to major losses, please therefore consult your financial advisor before making any decision. No content on our Site is meant to be a solicitation or offer.