Hotbit is Listing CREDIT, Africa’s Most Promising Cryptocurrency

TerraCredit is on a mission to circulate the cryptocurrency market and help the unbanked and unfortunate without competition. Hotbit announced bringing CREDIT onto its platform, whereby the official launch will be on August 3.

However, depositing CREDIT on the platform will open on July 31, while trading will open as of August 3. CREDIT will be trading against USDT, to begin with, hoping to increase the trading pairs as time goes by.

Terra Credit has been vigilant about its worldwide adoption, and soon, CoinPayments will list the coin. CREDIT has a long way to go, and this is just the beginning of a bright future for the currency.

Why Choose CREDIT?

Besides its focus on reaching the world’s unbanked, CREDIT aims to be a cash alternative, a reward token, a long-term investment option, and a cryptocurrency. Looking into CREDIT’s features on a more intrusive level will help you understand the benefits of having it as your crypto of choice.

- Safe from 51% Attacks: Every new crypto has to deal with this issue from its inception. Security is on everyone’s mind, and you want to be sure that your digital assets are safe. The ecosystem has over 12,000 miners devoid of competition as it is in a PoW protocol. For this reason, such attacks are impossible.

- Accessibility: Terra Credit has come up with a variety of wallets for every user. Currently, there are IOS, Raspberry, Windows, Android, Web, and Terrabit. Terrabit is a mobile application that allows you to have your wallet wherever you go. Most of these wallets allow CREDIT auto-staking after an 8-hour maturity.

- Low Transaction Costs, Fast Transactions: Terra Credit does not sacrifice speeds for security. The ecosystem enables 1-minute speeds working towards making the transactions under a second. Costs are below 0.00000003 USD for all transactions globally, saving funds for you. Instant transactions are available with 0 confirms.

- Rewards: There are several exciting components to earn from CREDIT, such as Masternodes and staking rewards. The network supports a MiniPOS wallet is a smartphone wallet that eliminates the need for a PC to earn staking rewards. However, all other wallets support staking as well.

These are a few of what CREDIT offers you as a holder and user of the ecosystem as the list is seamless and ever-growing. Currently, CREDIT is introducing its swap feature, which will facilitate the exchange of CREDIT for others at a predetermined rate.

Advantages of CREDIT on Hotbit

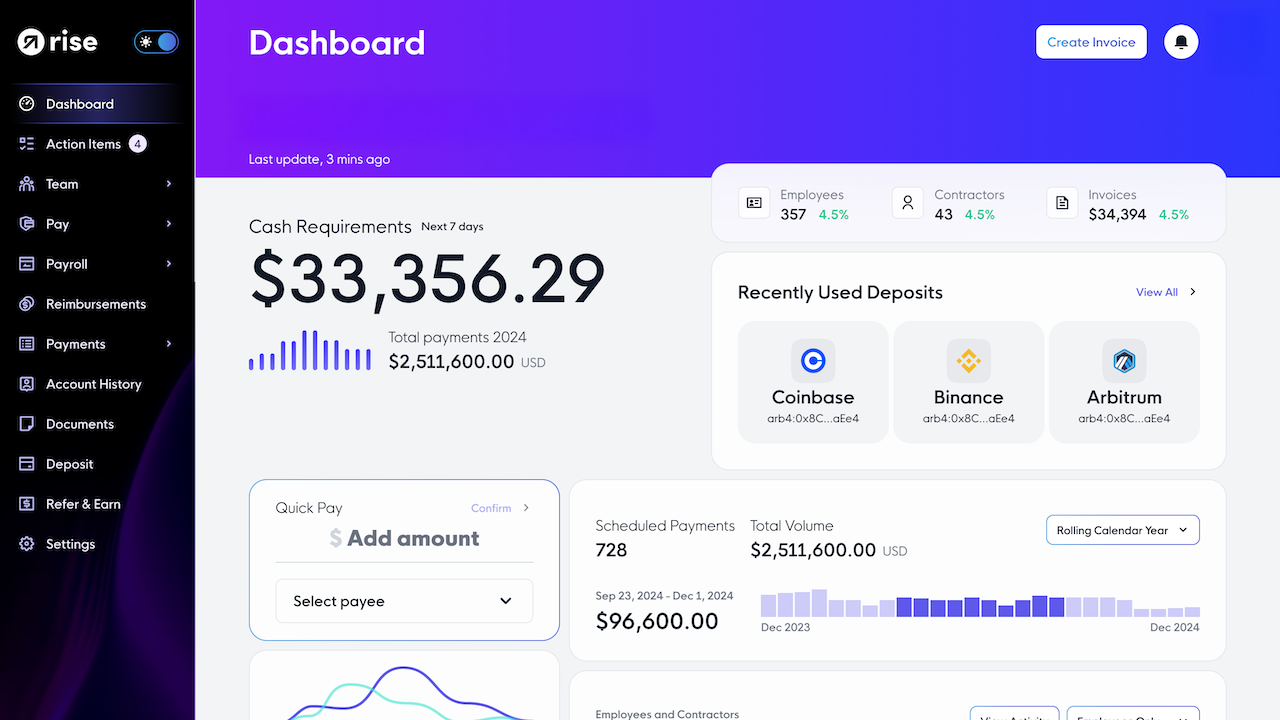

Hotbit is a centralized exchange platform offering over 50 trading pairs and among the top 50 exchanges in terms of the trading volume. It supports usability on different devices while ensuring availability in various languages as per its customers.

CREDIT is bound to benefit mainly from the listing by its market availability through the vast exchange platform. Hotbit strives to meet Wall Street type of standards providing the best market analysis backed with high liquidity. It will facilitate 24/7 services with their support team on standby for any assistance.

Through Hotbit, CREDIT is guaranteed a sound security system with the help of two auditing teams, including SlowMist and Beosin. The two are accountable for monitoring any security threats and technical glitches within the exchange platform.

About CREDIT

CREDIT is an African-native cryptocurrency launched by the Terra Foundation, a South African company. Previously, it was a PoS/PoW hybrid but fully transformed into a PoS protocol. It offers you a chance to earn passively through staking without any completion and saving your energy costs.

CREDIT’s objective is to reach the world’s unbanked to tap the potential of the investment that lies dormant due to the inaccessibility of banking and other financial services. Realizing the extensive use of mobile devices is a vital force to the integration of a range of wallets to cater for everyone’s needs. As per Terra Foundation’s Founder, Dan Ronchese, the only way to issue crypto into the global payment system is to access all users.

NEVER MISS AN ARTICLE!

We will get back to you as soon as possible

Please try again later

SUBSCRIBE TO OUR NEWSLETTER

Join the Newsletter

We will get back to you as soon as possible

Please try again later