CRYPTO SAVVY ARTICLES & MORE

Save Smart, Dream Big!

FEATURED POSTS

$LIVEBEAR, a community driven Solana based token built around culture, creativity, and real-world engagement, has officially announced a major milestone with the burn of 215 million $LIVEBEAR tokens, permanently removed from circulation by the development team. This strategic burn reinforces the project’s long-term commitment to sustainability, transparency, and community value. Originally launched as a simple livestream concept featuring a chill bear online, $LIVEBEAR has rapidly evolved into a global movement blending digital culture with real-life experiences. The project’s roadmap focuses on milestone-based activations, including live music collaborations, talent showcases, experiential events, and charitable initiatives each designed to bridge online communities with real-world impact. “Our vision has always been bigger than charts,” said the $LIVEBEAR team. “This burn represents our belief in the community and our commitment to building something that lasts. $LIVEBEAR is about good vibes, creativity, and showing up in the real world.” As part of its expansion strategy, $LIVEBEAR plans to stream and activate in cities worldwide, collaborate with artists and creators, and support charitable initiatives at key milestones. The project emphasizes entertainment-first content, community participation, and organic growth across social platforms. $LIVEBEAR continues to gain attention for its unique blend of meme culture, livestreaming, and real-life storytelling positioning itself as more than just a token, but a global cultural experiment powered by its community. For updates, events, and future milestones, follow $LIVEBEAR across official social channels. About $LIVEBEAR $LIVEBEAR is a Solana-based community token focused on entertainment, creativity, and real-world activations. Built around positive culture and milestone-driven experiences, the project aims to expand worldwide while giving back through community-led initiatives. X: https://x.com/LIVEBEAR_STREAM . YT: https://www.youtube.com/@LIVEBEAR_STREAM KICK: https://kick.com/livebear . DISCORD: https://discord.gg/mBGBqrUu . WEBSITE: https://livebear.life/ PUMP: https://pump.fun/coin/8dwC2K6jeNFCE1ZBWcLqTbqGkvSghMkb1m5dpXYLpump . TIKTOK: https://www.tiktok.com/@livebear_sol . DEX: https://dexscreener.com/solana/6cc7nbakjx936ymwsuwbrsppkywba7ht9xamfyqbqegy

A new Solana meme coin, $BULLISH, has launched with a clear, headline-friendly target: flip the market cap of Bullish (BLSH), a public company the project describes as sitting around the $5B mark. The campaign is being introduced alongside a narrative article titled “The Bullish Manifesto,” written by Patrick, which argues that traditional capital formation often ends the same way: early money exits near the top while retail buyers arrive late and absorb the drawdown. The manifesto angle In “The Bullish Manifesto,” Patrick claims “big money exited at the top” of $BLSH while retail kept buying and was left to suffer, a pattern he says shows up repeatedly across IPO cycles. He says the thesis pushed him to exit his entire $BLSH position and pivot into a public experiment with one goal: “Demonstrate, in real time, that a meme coin version can outperform every traditional capital stack that came before it, starting by flipping the $BLSH stock valued at $5.6B MC.” Why the campaign is leaning into the GameStop playbook The story is designed to feel familiar to anyone who watched the GameStop era unfold.c The $BULLISH narrative points to a moment when crowd conviction challenged institutional positioning and turned a “far-fetched” outcome into a market event. It also name-checks the archetype of the retail catalyst: Roaring Kitty, whose posts became synonymous with collective belief and a refusal to back down. In the project’s framing, it was another reminder that large institutions can take outsized risks while ordinary people live with the consequences. $BULLISH positions itself as a crypto-native remix of that energy: a simple ticker, a simple mission, and a community goal that can be understood in one sentence. The scoreboard: $BLSH vs $BULLISH At the time of writing (per the project’s own comparison), Bullish (BLSH) sits around a $5B market cap, while $BULLISH sits near $20M. The campaign argues that “flipping the stock” implies a roughly 250x move from current levels, while acknowledging the core memecoin reality: outcomes depend on attention, liquidity, and sustained community momentum. Where the campaign lives Follow campaign updates on X Track the token’s live chart Visit the official site Contract address (Solana): C2omVhcvt3DDY77S2KZzawFJQeETZofgZ4eNWWkXpump About Bullish Degen Bullish Degen ($BULLISH) is a Solana-based meme token positioned as a culture-first movement built on resilience, community, and unshakable optimism. The brand leans into a simple mission: keep the energy bullish, keep building, and keep showing up, even when markets get ugly. Bullish Degen focuses on community identity through visual culture, official merchandise, and interactive tooling like its PFP generator, all hosted on Bullish Degen . The project’s rallying cry is direct and meme-native: “You’re not bullish enough.” For real-time updates and announcements, follow X .

BlinkBot is a new AI-powered trading and transaction assistant on X.com. It removes the friction from on-chain crypto actions, allowing users to manage their portfolios, trade, swap tokens, tip creators and place prediction market bets simply by typing commands directly into a reply or DM. Actions that once required complex, multi-step processes like opening wallets, switching apps, copying addresses are now compressed into a single, intuitive interaction layer within X. For example: Set up a wallet: Type @blinkbotai Balance Trade: Type @blinkbotai buy $100 worth of ETH Token Generation Event & Airdrop Details The $BLINK token is coming on December 16th. The $BLINK token is launching with a pioneering Salutory governance model, designed to deliver unprecedented value and control. This new structure emphasizes Control , establishing a legally enforceable path for the company's acquisition solely through the token . This unique mechanism protects token holders by embedding direct ownership and transparency into the token itself, making the $BLINK token the definitive path to corporate control." We are committed to rewarding real users, not bots. The size of your airdrop allocation will be tied to your Proof of Usage , measuring actual engagement with the BlinkBot ecosystem. How to qualify: Engage with the platform by setting up a wallet, executing a trade, tipping a creator, and more. Key Capabilities: Built for Social, Designed for Usage BlinkBot is built for the everyday crypto user who is already tracking markets and narratives on X. Instead of redirecting users externally, BlinkBot brings the market to the conversation. Live Features Include: Multichain Token Trading: Trade supported tokens across major networks including Solana, Ethereum, Base, and BNB Chain directly from posts or private messages. Creator Tipping: Send value to creators instantly without complex wallet flows or browser redirects. Polymarket Integration: Place prediction market bets directly through BlinkBot, enabling fast access to real-world event markets without leaving X. Flexible Trading Modes: Execute trades transparently in public threads or privately via DMs. Wallet & Portfolio Dashboard: View balances and track multi-chain portfolios through the dedicated web interface. BlinkBot is designed for speed, allowing users to execute a trade or open a position the moment an opportunity is perceived, eliminating the lag between intent and execution. Trading via Contract Addresses (Live) & Ticker Trading (Upcoming) At present, BlinkBot supports trading only through Contract Address (CA) input. This ensures accuracy and helps users avoid mistakes that can occur when multiple tokens share the same ticker symbol. To protect users from potential fund loss caused by duplicate or misleading tickers, direct ticker-based trading will be introduced through a controlled whitelist system. Only verified projects will be enabled for ticker trading. This approach balances ease of use with user safety while gradually expanding ticker-based functionality. Multichain Execution BlinkBot is built as a chain-agnostic execution layer. This design allows users to interact across multiple ecosystems ( Ethereum, Solana, BNB Chain, and Base ) through a single command flow, moving between chains without the need to switch wallets or platforms. Polymarket Access Through Social Interaction BlinkBot’s integration with Polymarket allows users to interact with prediction markets exactly where information spreads fastest. Users can browse active markets, place positions directly from X, and react to real-time events with immediate execution. By embedding prediction markets inside social feeds, BlinkBot bridges the gap between news, sentiment, and on-chain action. Wallet Manager & Control The dedicated Wallet Manager and Portfolio Tracker provide a central hub to view and manage assets. Through the Wallet Manager, users can: View all connected wallets. Track balances across supported chains. Monitor portfolio activity. Manage execution access centrally. Access the Wallet Manager here: https://login.useblink.bot/ Availability and Next Steps BlinkBot is currently live with core trading, tipping, wallet management, multichain support, and Polymarket prediction market features. The team is actively developing additional functionality, including ticker-based buys, smart contract deployment, and a browser extension. The goal is to establish BlinkBot as the single unified execution layer across the most active on-chain ecosystems. Join the Waitlist & Ecosystem Today: Follow @teamblinkbot on X to stay updated. Initialize Your Wallet: Reply to any post (or send a DM) with the command: @blinkbotai balance (This automatically generates your secure BlinkBot wallet address.) Verify: Join our Discord for updates and verification: https://discord.gg/jVw5gNfdV6

Wiener , a new mobile analytics platform for the Solana ecosystem, has launched globally on the Apple App Store. The app converts Solana’s continuous on-chain activity stream into a curated set of actionable signals designed for everyday market participants. Solana’s low fees and high throughput have made it one of the busiest networks in the digital-asset sector. The same speed, however, generates an overwhelming volume of data. Wiener aims to make that information more accessible by filtering and ranking on-chain events in real time. This strategy presents only the developments most likely to influence market attention. “Most retail traders do not need more dashboards. They need clarity,” said Tetiana Kvashuk, creator of the Wiener app. “The goal is to surface meaningful events the moment they occur, without requiring users to sit inside terminals all day.” A Push-First Approach to Market Intelligence Wiener operates on a notification-driven model. Subscribers receive alerts on emerging tokens, unusual on-chain behaviour, wallet activity, and momentum changes across the Solana landscape. These signals come in real time. This means users can see how the market is moving without having to constantly check social media or analytics sites. Token profiles in the app give users quick looks at liquidity, ownership concentration, recent activity, and basic safety indicators. The layout is simple on purpose so that it is easy to read instead of having complicated charts. Advanced users can access modules such as Fresh Wallets, Good Traders, Bots, Whale Map, KOLs, and X Stats. These tools highlight newly active addresses, historically effective trading patterns, automated trading behaviour, large-holder movements, and social-driven shifts. Built for Simplicity, Independent by Design Although Wiener ingests large amounts of blockchain data, its interface is structured around a small set of metrics. This system is designed to allow for quick data interpretation, rather than overwhelming users. All buying and selling happens outside of the app on platforms that the user chooses. Wiener's published privacy policy says that it is not an exchange, wallet, or custodial service. To clarify: Wiener does not store or move crypto assets. This separation lets the project focus only on analytics and notification services. About Wiener Wiener is a mobile analytics app focused on real-time alerts and simplified on-chain insights for the Solana blockchain. The combination of continuous monitoring with structured filtering is at the core of this initiative. In fact, the app aims to help retail participants understand fast-moving markets without relying on complex trading tools. Wiener does not custody assets or execute trades and is not affiliated with the Solana Foundation. Wiener is free to download but requires a subscription to access any functionality. Plans - Basic Weekly, Premium, and Pro - are available through Apple’s in-app purchase system. Pricing varies by region; in the United States, subscriptions currently range from $3.99 per week to $17.99 per month depending on alert volume and feature access. Subscriptions renew automatically and can be managed through the user’s Apple ID settings. The Wiener app is now available for iPhone devices running iOS 13 or later. Anyone can find it under the name “Wiener” in the Finance category of the App Store. Further information is available on the project’s official website and on the social media pages listed below. X (Twitter) | Telegram | Instagram | Discord

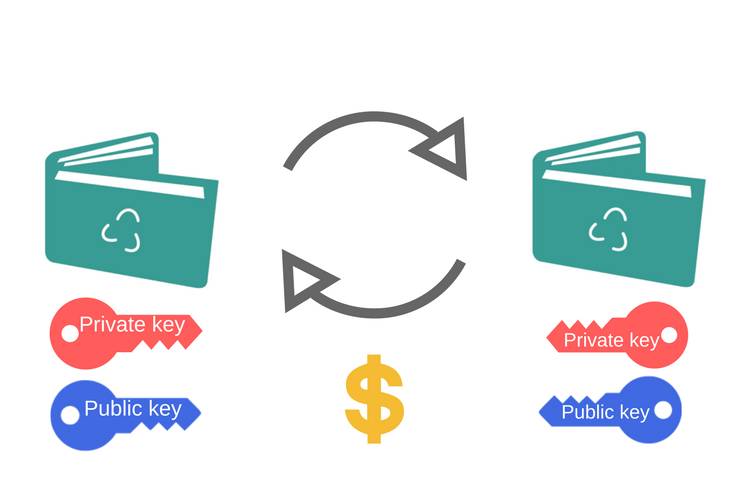

BEGINNER'S CORNER

See these articles to get you started in the crypto world